Last Updated May 18, 2025 by Davina Kelly

Are you tired of wondering where your money went after every payday? This payday routine will help you finally take control of your finances.

In this post, I’ll walk you through my seven-step payday routine that has completely transformed my finances. Following this routine helped me get out of payday loan debt and save $50k so I know it can help you too.

After reading this post, you’ll know how to save money, build wealth and make your money work for you.

This post may contain affiliate links, which means we will receive a commission if you purchase through our links, at no extra cost to you. Please read full disclosure for more information.

Step-By-Step Payday Routine To Build Wealth:

Having a structured plan on payday is essential. It’s also important to have a clear understanding of the goals you’re working toward.

For example, do you want to pay off debt? Are you saving for retirement? Knowing your priorities will help you create an effective payday routine that aligns with your financial objectives.

This is what I focus on each payday

- Investing my money

- Saving for a property downpayment

- Contributing to my holiday fund

- Allocate an allowance for fun

Check out my video below for a more in depth breakdown.

Step 1. Manage Your Money

Once payday arrives it’s time to get to business. First, check your bank account to ensure your income is correct. Check the amount against your payslip and confirm everything from your tax deductions to pension contributions is correct.

Next, look at your bills. I’ve automated this process so all of my bills are deducted on the same day. This helps me stay organised and ensure my bills are paid on time.

Checking to make sure the right amount has left your account is important. I like to log in to my bank account and double-check that all the amounts are accurate.

Step 2. Pay Yourself

Paying yourself first can make a big difference in your finances. Incorporating this into my payday routine helped me achieve my financial goal of saving for a house deposit.

The idea is simple. Before you spend money on anything else, set aside a portion of your paycheck for savings. This ensures that you prioritise your future financial security rather than focusing on immediate wants or needs.

Did you know that according to studies, 78% of Americans live paycheck to paycheck? That is an alarmingly high number! You can avoid falling into this statistic by saving some of your money each month even if it’s just $100.

If you don’t have any savings yet, I recommend prioritising building up one month’s worth of living expenses. Just having this cushion will give you peace of mind. It will also save you from going into debt if an emergency arises such as your boiler breaking down.

Once you’ve calculated one month’s living expenses, save that amount in an account that offers high interest but is easily accessible. This way you can earn interest on your savings.

Step 3. Make Debt Payments

Debt can be a financial trap, especially high-interest debt like credit cards. The longer you carry this debt, the more you pay in interest which makes everything you bought on credit more expensive.

For example, let’s say you booked a $2,000 holiday on your credit card with a 24% interest rate. If you don’t pay it off within a year, that holiday will actually cost $2,480.

That’s an extra $480 you could have saved or invested. Therefore, it’s crucial to prioritise paying off high-interest debt before building a savings fund.

Start by listing all your consumer debts, then decide whether to use the snowball or avalanche method to pay them off. The snowball method focuses on paying off the smallest debts first. This gives you quick wins that build momentum and motivation.

The avalanche method, on the other hand, targets the high-interest debt first which saves you money in the long run.

Personally, I used the snowball method to get out of payday loan debt. It was the most manageable option for me and those small wins kept me motivated.

Ultimately, choose the method that works best for you. Once you’ve chosen your method allocate a portion of your paycheck to pay down this debt.

Step 4. Put Your Money To Work

One of the most impactful steps I incorporated into my payday routine was investing in the stock market. This not only helped my money grow but also allowed me to benefit from the magic of compound interest.

To be honest, the sooner you start investing, the better because time is your greatest ally. But it’s never too late. If you’ve completed the previous steps and have some extra funds, now is the best time to start investing.

Even if you can only invest $50 or $100, no amount is too small. Trust me, when you see your money grow through capital gains you’ll be glad you took the leap.

I started investing with just $250 a month and have since built a five-figure portfolio with minimal effort.

Utilise any tax-free accounts available to you, such as the Roth IRA in the US or the stocks and shares ISA in the UK.

These accounts offer tax benefits that can significantly increase your returns over time. For example, in the UK the stocks and shares ISA allows you to invest in stocks, Index funds and ETFs up to £20k with all gains being tax-free.

If you’re new to investing, I suggest starting with Index funds. They are diversified, low risk and have low fees which is a great choice for beginners.

For more details on how to get started with index funds, you can read more here.

The key is to be consistent with your investments and choose a strategy that aligns with your risk tolerance and financial goals.

Step 5. Put Money Aside For Fun

I am a big believer in balance and building wealth shouldn’t mean sacrificing the things that bring you joy. So it’s important to allocate a portion of your income for fun and leisure activities.

This can include things like dinner out with friends, hobbies or any other indulgence you enjoy. By budgeting for fun, you allow yourself to enjoy life without feeling guilty or worrying about overspending.

Putting money aside for fun also helps you avoid the temptation to dip into your savings when you want to treat yourself. You can allocate a fixed amount of money or a percentage of your income.

If you choose to allocate a percentage I suggest no more than 10%.

Transfer this amount to another account so you can keep these transactions separate and spend freely.

Step 6. Update Your Budget For Last Month

Reflecting on your spending from the previous month is important. It will help you track your progress towards your goals and identify any areas for improvement.

After you’ve allocated your paycheck and made your money moves, take a few minutes to review your budget for the previous month.

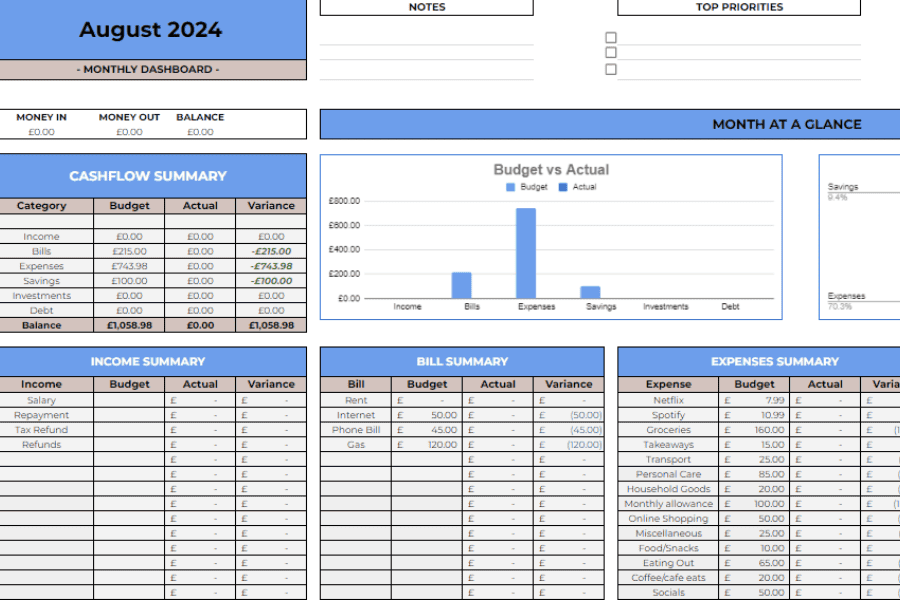

For this step, I log into my online banking and export my bank transactions from the previous month. Then I pull up my budget tracker, paste in the transactions and categorise them.

The budget sheet I use contains formulas so everything is automated. I just need to select the category from the list. Here is the budget tracker I use.

Once I’ve updated my tracker I’ll look at the spending categories and compare my actual spending to my budgeted spend to asses whether I stayed within my limit.

While reviewing your numbers ask yourself did you overspend in any areas? Were there unexpected expenses that threw off your budget? How can I do better next month?

By reviewing your budget you can identify areas where you might need to adjust your spending habits. This step is all about learning from your financial past to improve your financial future.

Step 7. Plan For The Current Month

Finally, it’s time to plan for the current month. This can include planning for any upcoming large bills or social events or cutting back on non-essential spending.

For example, if you overspent on takeaways last month you might want to spend less this month.

By setting clear intentions at the beginning of the month, you’re more likely to stick to your plan and make progress towards your financial goals.

Planning for the month ahead also allows you to anticipate any upcoming expenses like birthdays, holidays or seasonal bills. If you account for these in your budget, you’ll avoid surprises and maintain better control over your finances.

Final Thoughts about Payday Routine

By following this payday routine every time you get paid, you’ll not only improve your financial discipline but also ensure your money is working for you.

So, the next time payday comes around, remember to follow these steps and watch your financial situation transform!

What do you do in your payday routine? Let me know in the comments below.

This post was all about the best payday routine.

Other Posts You May Like:

15 Easy Money Management Tips for Beginners

19 Personal Finance Tips Everyone Should Know

Investing Money For Beginners: The Ultimate Gude

Davina Kelly

Hey! I'm Davina, the owner of Davinas Finance Corner. I'm passionate about finding ways to budget, save, earn more money and improve your life. After breaking free from payday loan debt and living paycheck to paycheck I want to share my experience to help other women improve their finances.

I am totally agree with this post!!!